Getting To Know The Affordable Care Act For Designers

A look at freelance designers’ health insurance options through the ACA

So, you have spent long hours slumped over your computer furiously smashing hotkeys, making precise mouse gestures and all around getting stuff done. Suddenly, you feel a twinge of pain in your hand, or maybe you are getting that scratchy feeling at the back of your throat.

When these kinds of things happen, which they will, freelance designers are not only less likely to take a sick day (there are no paid sick days when you are a freelancer), but less likely to have a good health insurance plan to take care of the problem. The premiums that freelancers have to pay compared to their employee friends aren’t a pretty thing.

For many freelancers, the Affordable Care Act (ACA) will be a breath of fresh air. The law is pretty darn extensive, and a lot of big changes and revisions are being put into the healthcare system. Some of these are sure to change things for the better. Read on to learn about some of the changes that are likely to affect you.

Benefits On Each And Every Plan

The ACA is working to make many cheaper plans a more viable option by bringing into play a set of essential health benefits that every plan is required to cover. Such benefits include categories like preventative service and maternity care. You can learn about the rest at HealthCare.gov’s glossary entry for the essential health benefits here. You will note I said “categories” here because that is what these benefits are, categories of benefits.

The specific medical services in each category are outlined on a state by state basis, so you will have to do some research to find out what services are covered in your state. A good place to start is here.

Let’s Look At Some Plans

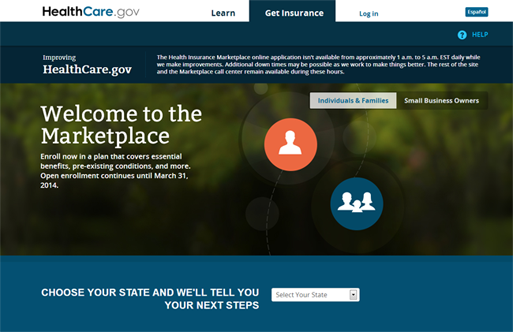

A majority of consumers will buy health insurance at the healthcare.gov website, home to the federal exchange. Others will buy it at their state’s very own exchange. To see if your state runs its own exchange, check out the Kaiser Family Foundation’s list right here.

On state and federal exchanges, plans are organized based on their premiums and coverage into four different tiers: Bronze, Silver, Gold and Platinum. As expected, Platinum has the highest premiums and covers the highest percentage of costs. This broad range of plans makes it so that you can find a plan on the marketplace whatever your needs might be.

On another note, learn How to Start your Design Career.

Introducing Everyone’s Favorite: Tax Subsidies!

For graphic designers who makes between 100 and 400 percent of the Federal Poverty Line, you can get a tax subsidy on plans that you buy on the federal or state marketplaces. I can’t tell you the actual value of this tax subsidy because it can vary based on all sorts of different things. Thankfully, the Kaiser Family Foundation helps us yet again with a subsidy calculator that can give you a number to work with.

What You Have To Do Before Buying A Plan

Alright, you have some information you can actually work with now. Whatever path you choose to take for buying health insurance, there are some things that you are definitely going to want to do beforehand. Basically, you want to begin your health insurance search as informed as possible.

A good first step looking at how much you’ve spent on healthcare in the past. This will give you a ballpark number to work with for a health insurance budget. Then you ask yourself a few questions: Who else is being covered by this plan? Do I or any of my dependents have a pre-existing condition (or two)? How often do I want to see the doctor? By no means is this an exhaustive list of questions, but it’s a good place to start. Once you have some of these answers in hand it’s time to log on and check out your health insurance options.

Conclusion

So, keep on learning as much as you can about this stuff. Even if you are pretty savvy already, the changes brought on by the ACA may require you to take another look at things. When looking for outside guidance on the topic, the best thing to do is talk to a licensed insurance broker, because they know their stuff when it comes to this. In any case, being astute about this can only serve to help you choose a better health insurance plan.